indiana excise tax deduction

Average ExemptionDeduction Amount per Return. What is the excise tax rate in Indiana.

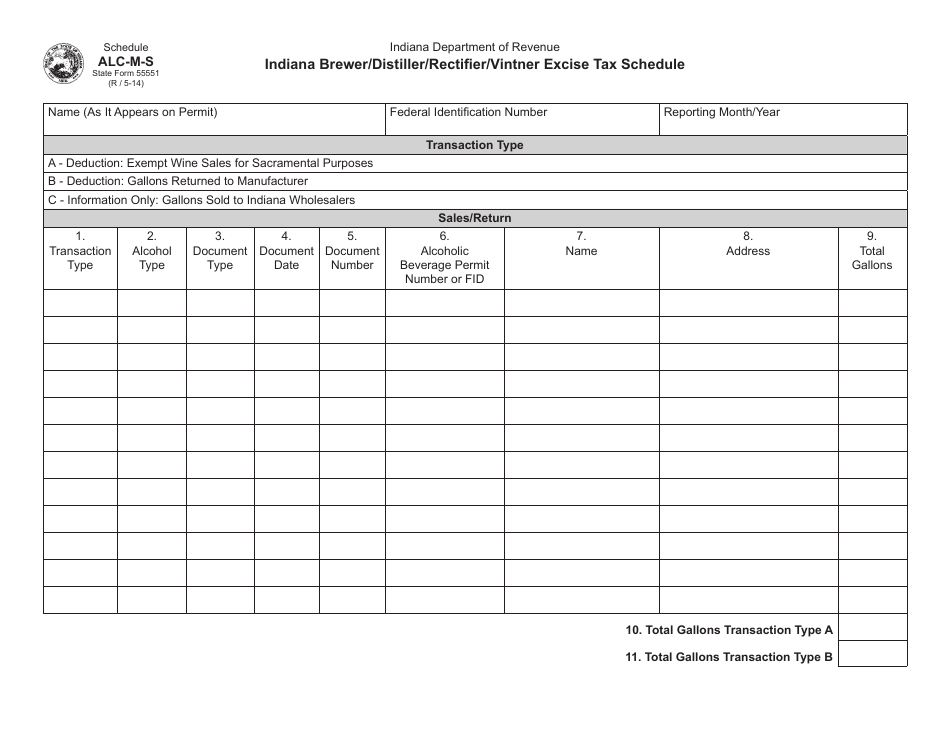

Form Alc M State Form 55551 Schedule Alc M S Download Fillable Pdf Or Fill Online Indiana Brewer Distiller Rectifier Vintner Excise Tax Schedule Indiana Templateroller

Model year 1980 or older passenger vehicles trucks with a declared.

. The percentage ranges from two percent to ten percent with a minimum of 750 per vehicle. Calculate excise tax based on a dollar amount. IN Code 6-6-5-52 2018 IC 6-6-5-52 Credit for certain.

The IN County Wheel Tax is based on the type and weight of a vehicle not the. You may be able to claim a credit if. Passenger vehicles and recreational vehicles have.

For example some states refer to certain vehicle registration fees as an excise tax. A veteran who owns a vehicle and is entitled to a deduction under IC 6-11-12 sections 13 14 or 16 and has any remaining deduction from the assessed valuation to which. The only vehicle registration fees that are deductible are those based on the value of the vehicle.

The alcoholic beverage excise tax is imposed on all alcoholic beverages at a per-gallon rate paid by Brewers Wholesalers and Permittees in Indiana. This type of equipment was previously subject to personal property tax however HEA 1323 2018 imposes this new tax type effective January 1 2019. Property tax forms are managed by the Indiana Department of Local Government Finance not the.

The amount of the Indiana County Income Tax shown on Form IT-40 line 9. Use this form to apply for the Disabled Veteran Deduction from your Indiana county. Motor Vehicle Excise Tax.

Rehabilitated Property Deduction Form. Human Services Deduction. Indiana Net Operating Loss Deduction.

The flat rate ranges from 750 to 25 per. The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A. The per-gallon rates are as follows.

Excise taxes imposed on personal property vehicles campers boats RVs etc are an. Historical Rehabilitated Property Deduction Form. Motor driven cycles MDCs are charged a flat rate vehicle excise tax of 1000.

But this amount is actually called an excise tax and not a property tax. Vehicle Excise Tax Flat Rate 12. Many of our county.

Heritage Barn Deduction Form. Geothermal Solar Wind or Hydroelectric Deduction Form. A portion of Indianas vehicle registration fees are tax deductible.

The excise tax credit is equal to the lesser of the excise tax due for the specific vehicle or 70 and can be applied to two vehicles owned by the veteran. For example if real estate is taxed at 150 per 100 and the purchase price of a piece of property is 130000 then the. The heavy equipment rental excise tax.

Whether registering a vehicle for the first time or renewing registration all customers pay an annual excise tax and a registration fee. Lake County Residential Income Tax Credit. You paid property tax to.

Indiana Department of Revenue Indiana Farm Winery Excise Tax Schedule Name As It Appears on Permit Federal Identification Number Reporting MonthYear Transaction Type A -. It is based on the value of vehicle. Credit for certain veterans who are not eligible for a property tax deduction.

Every Electric Vehicle Tax Credit Rebate Available By State

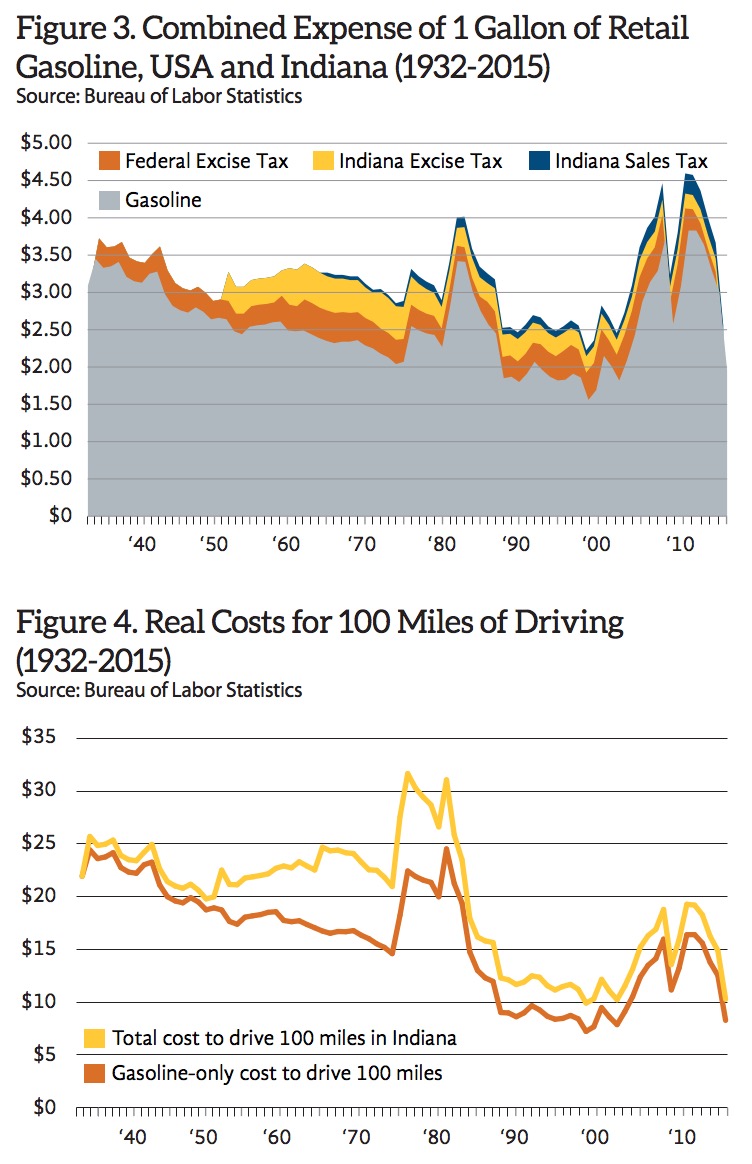

Indiana History And Analysis Of Gas Taxes Infrastructureusa Citizen Dialogue About Civil Infrastructure

Massachusetts Indiana Utility Receipts Tax Not Required To Be Added Back In Computing Massachusetts Corporate Excise

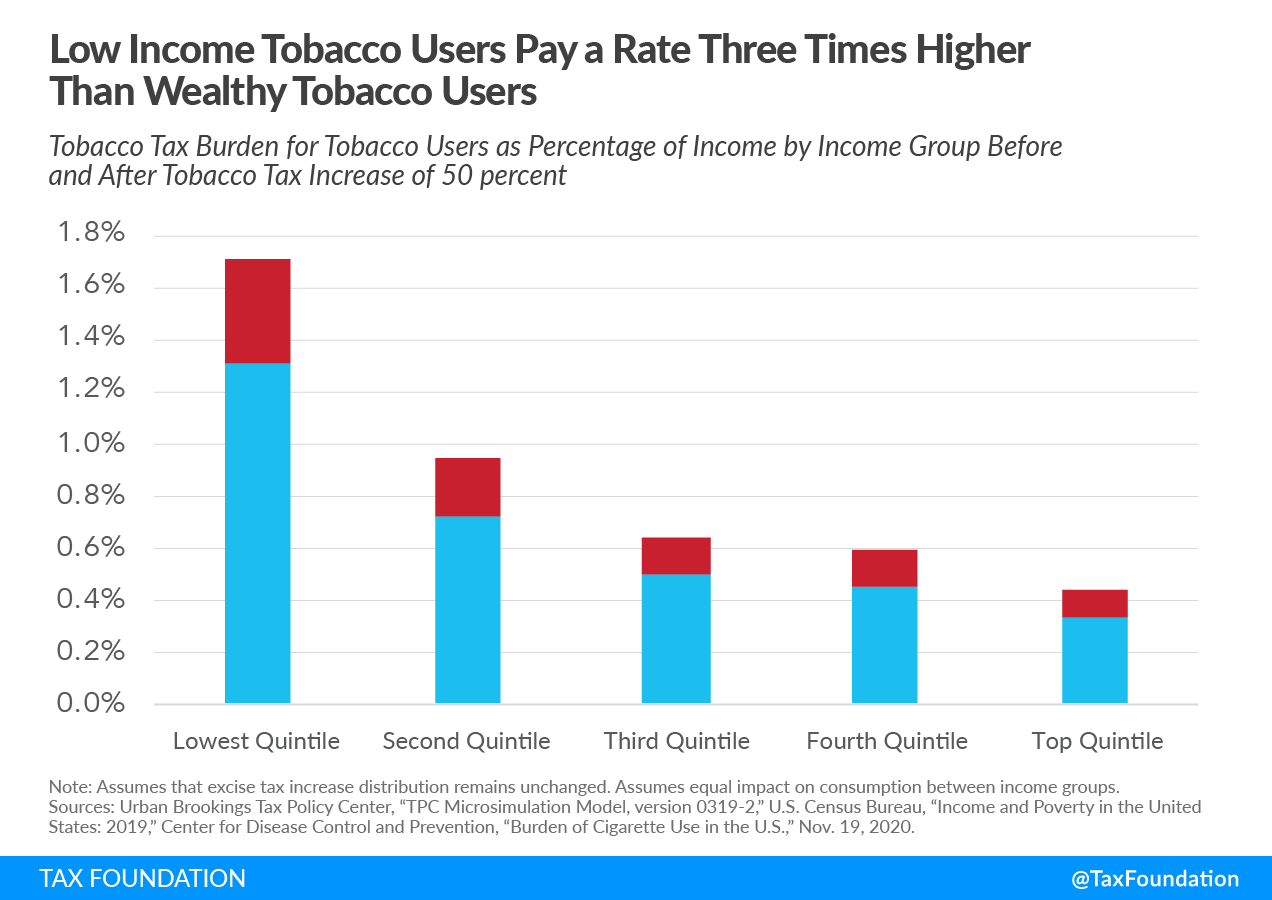

Excise Taxes Excise Tax Trends Tax Foundation

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan Itep

Most Popular Tax Deductions In Indiana March April 2011

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Other Tobacco Product Distributors Excise Tax Return Opt M Indiana

How Do State And Local Sales Taxes Work Tax Policy Center

Most Popular Tax Deductions In Indiana March April 2011

Excise Tax In The United States Wikiwand

1952 Indiana Department Of State Revenue Gross Income Tax Bonus Tax Forms 1040 Ebay

Indiana Military And Veterans Benefits An Official Air Force Benefits Website

State Recreational Marijuana Taxes 2021 Tax Foundation

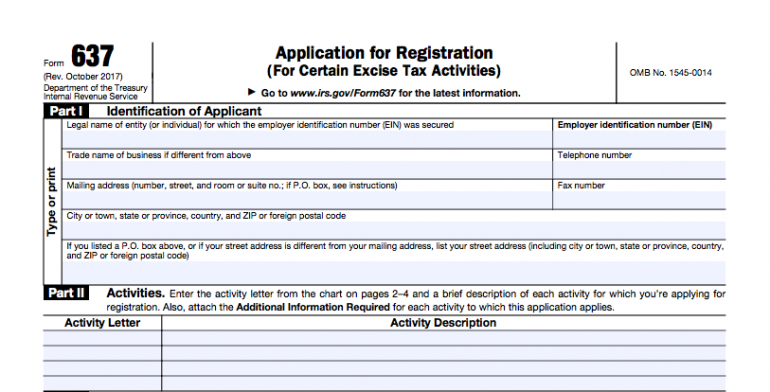

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger